closed end fund liquidity risk

Securities and Exchange Commission SEC adopted new rules and a new form as well as amendments to a rule and forms designed to promote effective liquidity risk management for open-end management investment companies funds. Diversification The portfolio offers investors diversification by investing in a broad range of closed-end funds that are further diversified across hundreds of individual securities.

Understanding Interval Funds Griffin Capital

In addition closed-end funds dont have to manage fund liquidity to meet potentially large redemptions.

. Closed-end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund. 26 2021 GLOBE NEWSWIRE -- The Boards of Trustees of the PIMCO closed-end funds below each a Fund and. Unlisted closed-end funds also provide limited liquidity.

Funds or funds4 or closed-end upon which several of the Acts other provisions depend. Its assets are actively managed by the funds portfolio managers and may be invested in equities bonds and other securities. Closed-end funds can offer opportunities but they come with risks.

Closed-end funds can be subject to liquidity problems both at the level of the fund and at the level of the shareholders Faust says. Closed-end funds unlike open-end funds are not continuously offered. The results thus support the liquidity explanation for the closed-end fund discount.

There is a one-time public offering and once issued shares of. Shares of closed-end funds frequently trade at a discount to the net asset value. In October 2016 the US SEC adopted new rules designed to promote effective liquidity risk management for open -end funds.

Any product that seeks results. In July 2016 the HK SFC published a circular providing additional guidance to asset managers particularly in relation to liquidity risk management. Investment policies management fees and other matters of interest to prospective investors may be found in each closed-end fund annual and semi-annual report.

Liquidity riskThe liquidity of a closed-end fund is typically similar to in closed-end funds. The Problem With Investing In Open-Ended Life Settlement Funds While open-ended funds offer more liquidity than closed-end funds open-ended funds also have lower returns and the management and performance fees are often based on the net asset value of the fundwhich can be hard to accurately assess for assets with unlevel cashflows. The Liquidity Rule also requires principal underwriters and depositors of unit investment trusts to engage in a limited liquidity review.

When investing in closed-end funds financial professionals and their investors should first consider the individuals financial objectives. A closed-end fund is a type of investment company whose shares are traded on a stock exchange or in the over-the-counter market. Their yields range from 632 on average for bond CEFs to.

A Small Entity Compliance Guide Introduction. The risks in their small size center around liquidity and are largely theoretical. Shares may only be purchased or sold through registered brokerdealers.

Just like open-ended funds closed-end funds are subject to market movements and volatility. Shares of closed-end funds CEF are sold in the open market through a stock exchange. The SEC adopted Rule 22e-4 the Liquidity Rule requiring each registered open-end fund including open-end ETFs but not money market funds to establish a liquidity risk management program.

This can result in. Closed-end funds CEFs can be one solution with yields averaging 673. For additional information please contact your investment professional.

Closed-end funds remain the smallest part of the investment universe which brings both risks and opportunities. Rule 22e-4 also requires principal underwriters and depositors of unit investment trusts. Manzler 2004 shows that the discounts on closed-end funds are driven by.

However closed-end funds have several important differences compared to the mutual. NEW YORK Nov. Funds ETFs but not including money market funds to establish a liquidity risk management program.

The closing price and net asset value NAV of a funds shares will fluctuate with market conditions. On October 13 2016 the US. The Closed-End Fund Structure Has Significant Advantages CEFs have a superior wrapper that helps to provide some advantages to the holder if they can be taught how to weather the added price risk.

Investment constraints such as risk tolerance liquidity needs and investment time horizon should be taken into consideration. The price of a funds shares is determined by a number of. The value of a CEF can decrease due to movements in the overall financial markets.

On October 13 2016 the US. Closed-end funds unlike open-end funds are typically not continuously offered. A closed-end fund is a type of mutual fund that issues a fixed number of shares through a single initial public offering IPO to raise capital for its.

CEFs are exposed to much of the same risk as other exchange traded products including liquidity risk on the secondary market credit risk concentration. Securities and Exchange Commission Commission unanimously adopted new Rule 22e-4 Liquidity Rule under the Investment Company Act of 1940 the 1940 Act and other regulatory changes that require each open-end fund including traditional mutual funds and exchange-traded funds ETFs but excluding money market funds MMFs. The UK FCA published additional.

Investing In Closed End Funds Nuveen

Closed End Fund Fs Investments

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

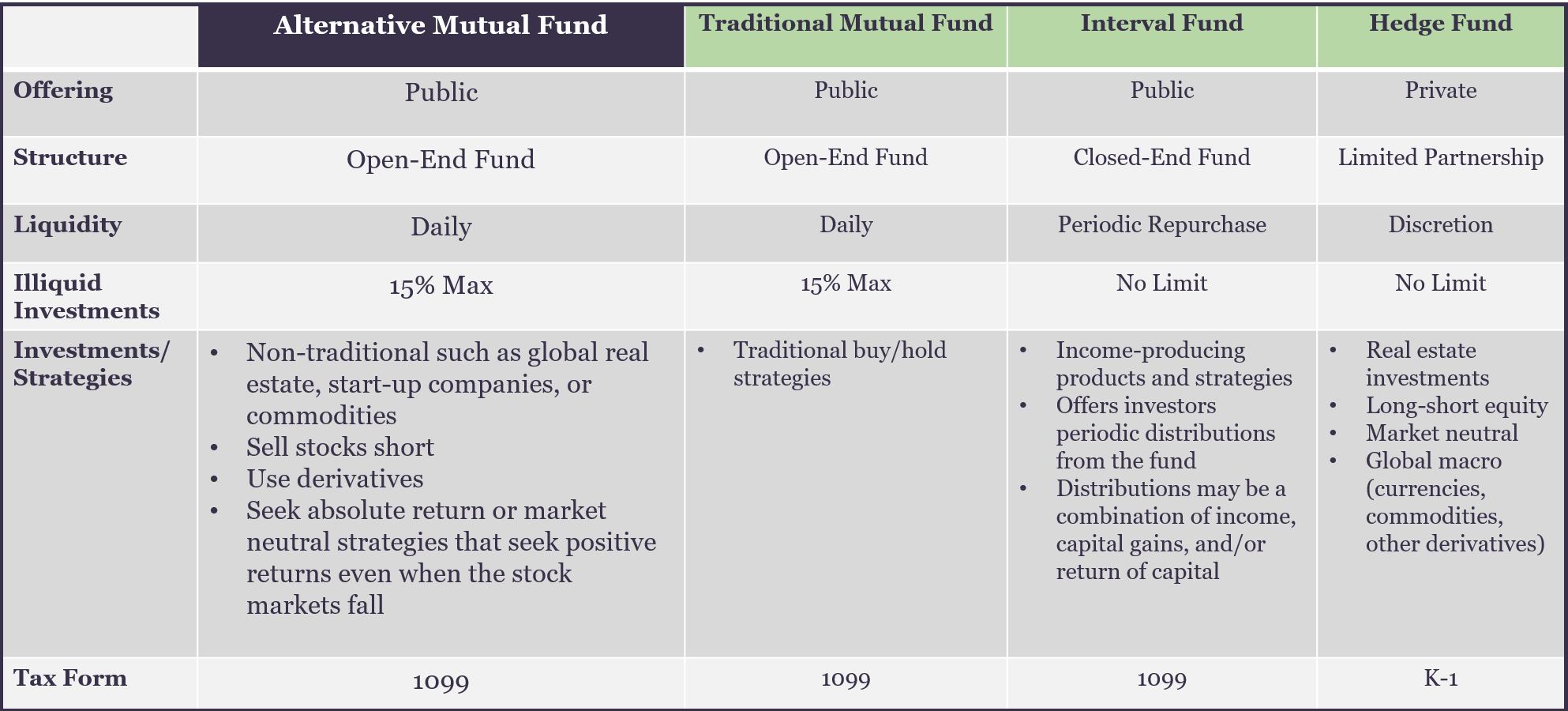

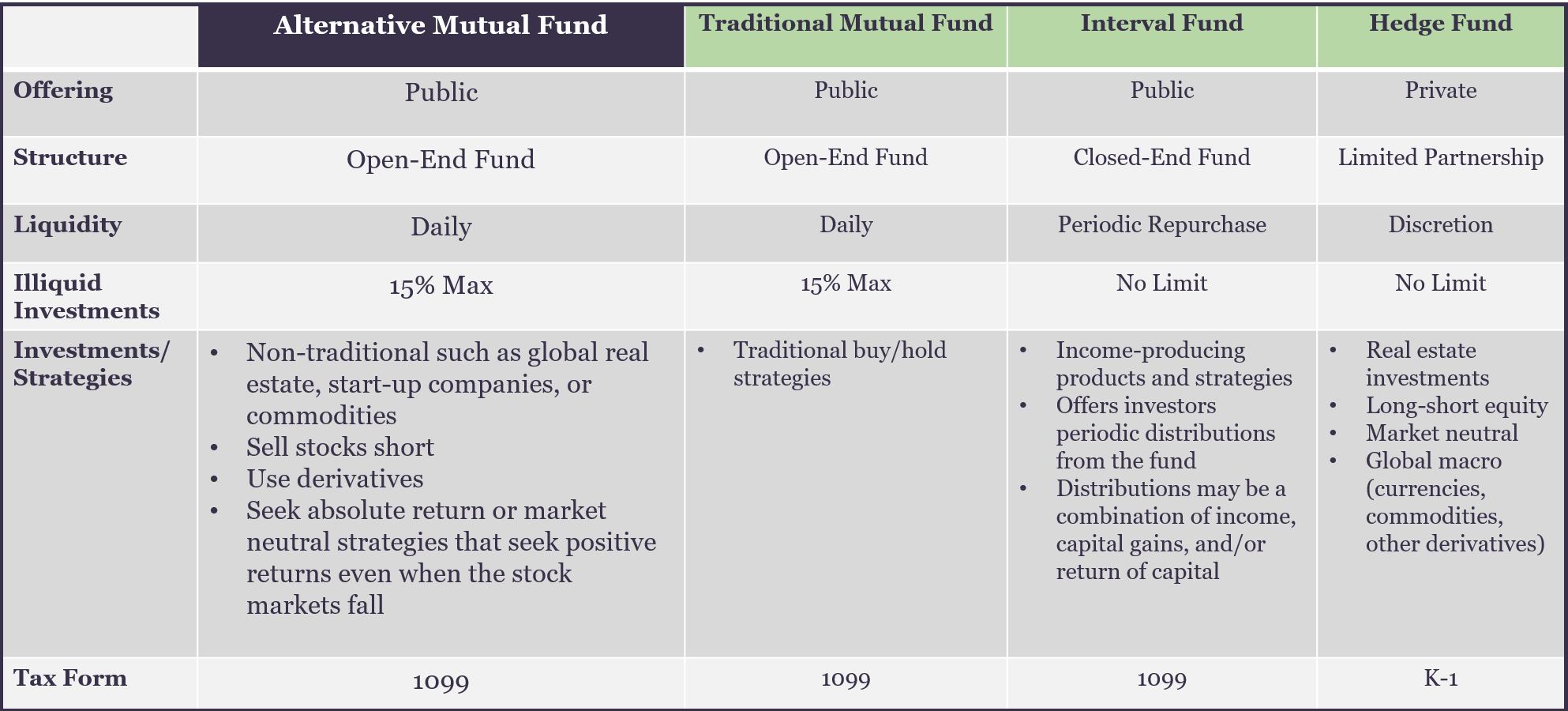

Alternative Mutual Fund Liquidity Spectrum Investment Comparison

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Closed End Fund Definition Examples How It Works

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Pdf A Liquidity Based Theory Of Closed End Funds

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends